Cycle to work scheme vat treatment online

Cycle to work scheme vat treatment online, Cycle to Work Scheme guidance for employers online

$0 today, followed by 3 monthly payments of $12.33, interest free. Read More

Cycle to work scheme vat treatment online

Cycle to Work Scheme guidance for employers

Cycle To Work Cyclescheme Bikes In Carlisle Cumbria

Cycle to Work scheme now available for all ability bikes trikes

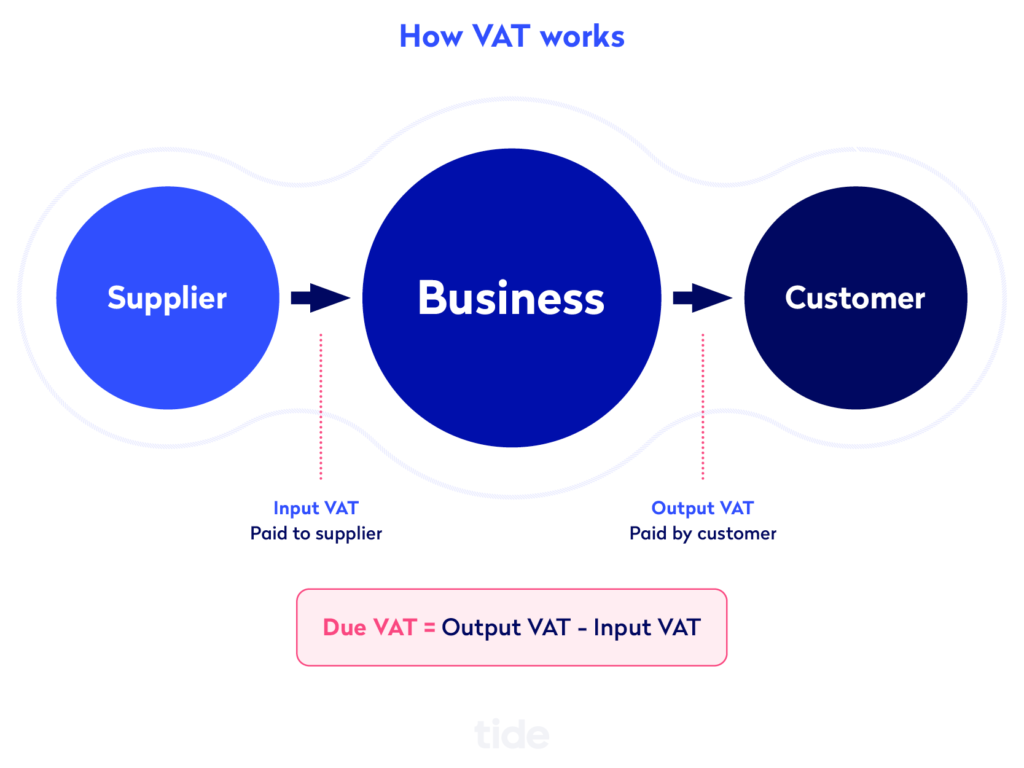

What is VAT how much is it and how much to charge Tide Business

Cycle2Work Cycle to Work Scheme Halfords UK

Tax saving on cycle to work explained

technology-tips.com

VAT Registration Tracking Filing and Payment in production online, What Is VAT Edward Thomas Peirson Sons Accountants online, The ultimate guide to salary sacrifice in the UK online, The tax benefits of electric vehicles Saffery online, Cycle to Work Scheme Can you claim for electric or ebikes online, Cycle2Work Cycle to Work Scheme Halfords UK online, Need to know more See our information packs Green Commute online, Salary sacrifice how it works Which online, 8 Different VAT Schemes in UK To Choose From online, The Cycle to Work Scheme just got even better GCI Blog 09Jun2022 online, VAT to be charged on Cycle to Work bikes BikeRadar online, The ultimate guide to salary sacrifice in the UK online, Tax saving on cycle to work explained online, Cycle2Work Cycle to Work Scheme Halfords UK online, What is VAT how much is it and how much to charge Tide Business online, Cycle to Work scheme now available for all ability bikes trikes online, Cycle To Work Cyclescheme Bikes In Carlisle Cumbria online, Cycle to Work Scheme guidance for employers online, Cycle to Work scheme for businesses Your Co op online, Tax Savings through the Cycle to Work Scheme for Limited online, Cycle to work scheme and capital allowances Taxation online, No limits on cycle to work scheme AccountingWEB online, Understanding salary sacrifice and the cycle to work scheme online, Cycle to Work Scheme SG Accounting online, Electric Bikes eBike Cycle to Work Scheme UK Electric Bike Centre online, Cycle to Work Scheme Charnwood Accountants online, HR Magazine HMRC clarifies VAT requirements for cycle to work online, Tax saving on cycle to work explained online, Cycle to Work scheme for businesses Your Co op online, Cycle to work scheme Plus Accounting online, Cycle to work scheme Taxation online, HR Magazine HMRC clarifies VAT requirements for cycle to work online, Employer How does salary sacrifice and the cycle to work scheme online, Employer How does salary sacrifice and the cycle to work scheme online, Cycle to Work Scheme guidance for employers online, Product Info: Cycle to work scheme vat treatment online.

-

Next Day Delivery by DPD

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

Our extended Christmas returns policy runs from 28th October until 5th January 2025, all items purchased online during this time can be returned for a full refund.

Find similar items here:

Cycle to work scheme vat treatment online

- cycle to work scheme vat treatment

- schwinn ic2i indoor cycling bike

- intense pro 20 bmx

- buy a bike scheme

- litespeed cyclocross

- vitus nucleus 2017

- cycle to work scheme tax

- network rail cycle to work

- bike to work scheme limit

- boots cycle to work scheme